Do you own a business in India, or are you thinking of starting one? Then you must know about the GST Certificate. It’s more than just a tax document. It gives your business a legal identity and opens doors to growth.

Whether you’re a new business owner or looking to understand GST compliance better, this detailed guide below will help you understand how to download a GST certificate, its uses, and different methods of GST number check.

What is a GST Certificate?

A GST certificate is a vital document for all businesses registered under India’s Goods and Services Tax (GST) system. It acts as legal proof of registration and is essential for carrying out taxable business activities across the country.

This GST Registration Certificate proves that a business or entity is registered under the GST Act 2017. It also allows businesses to collect taxes from their customers/clients. GST registration certificate is also known as Form GST REG-06.

Contents of a GST Registration Certificate

The Government of India issues a GST Registration certificate to businesses and individuals who register under the GST regime, and it contains the following key information:

- GSTIN (Goods and Services Tax Identification Number)

- Legal name and trade name of the taxpayer

- Type of taxpayer – Regular, Composition, or Casual

- Principal and additional place(s) of business

- Validity of registration (if applicable)

- Date of registration

- QR code and digital signature of the authority

It is issued in Form GST REG-06 and is available only in digital format on the GST portal.

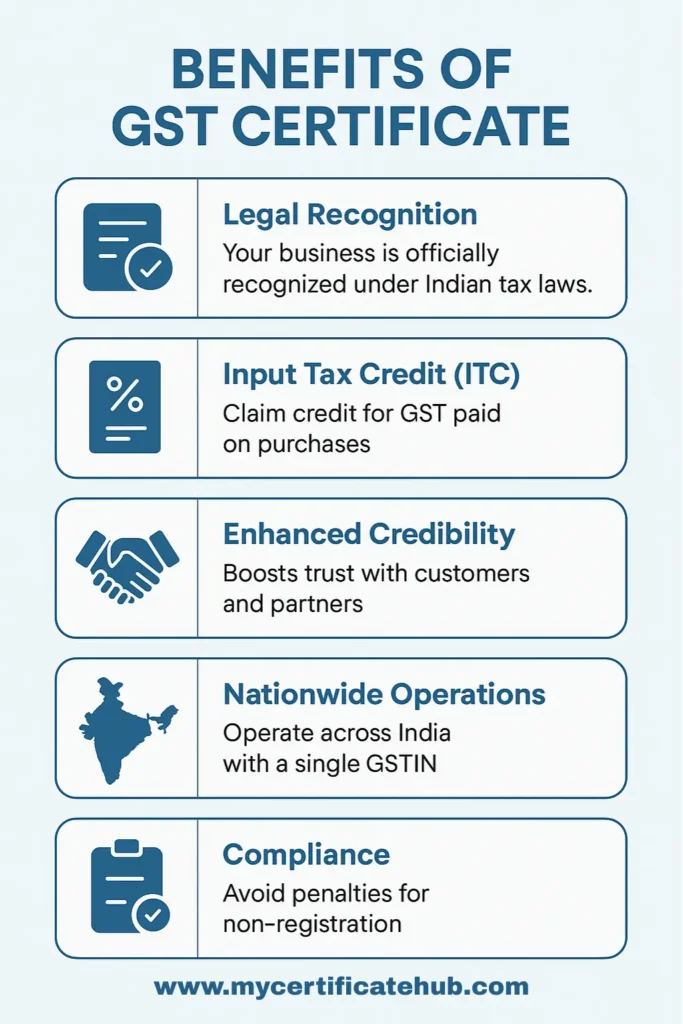

Benefits of GST Registration Certificate

- Legal Recognition: Your business is officially recognized under Indian tax laws.

- Input Tax Credit (ITC): The business owner can claim credit for GST paid on purchases, reducing overall tax liability.

- Enhanced Credibility: Boosts trust with customers and partners.

- Nationwide Operations: Operate across India with a single GSTIN.

- Compliance: You can avoid penalties for non-registration.

What is the GST Registration Fee?

The Government charges ₹0 free when the user registers directly via the official GST portal. However, if you seek Professional Assistance, these optional services may cost you approximately ₹1,000–₹5,000.

Useful Documents for GST Registration

Here is the list of documents for GST Certificate registration:-

- Aadhar Card

- PAN Card

- Incorporation Certificate or Business Registration Proof

- Bank Account Statement & Cancelled Cheque

- Passport-size photo of Business owner

- Address proof and ID Proof of the owner

- Authorization Letter/Board Resolution for Authorized Signatories

- Digital Signature

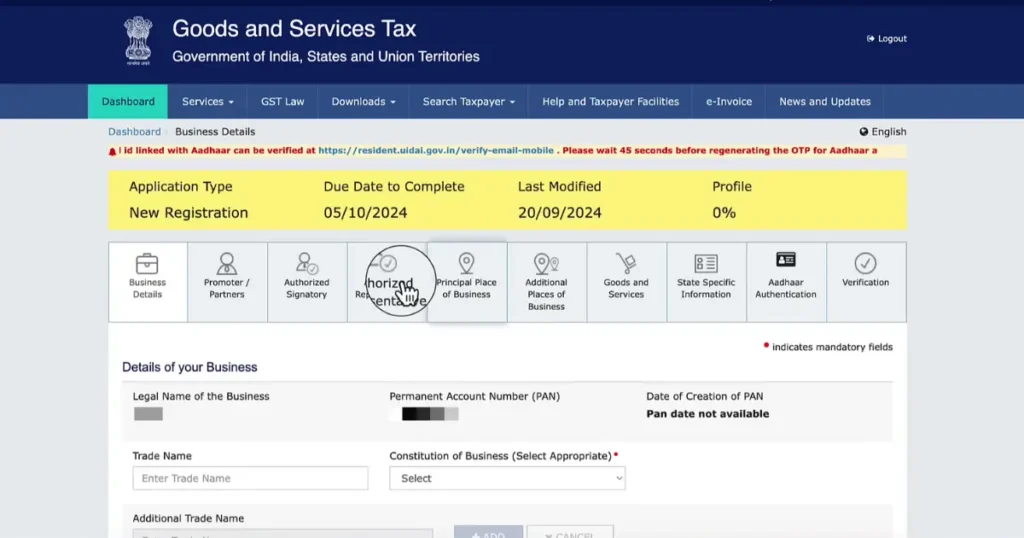

How to Obtain a GST Certificate/ GST Registration Process

If you are thinking how to obtain a GST Registration certificate, here is the step-by-step process-

Step 1: Visit the official GST Portal at www.gst.gov.in

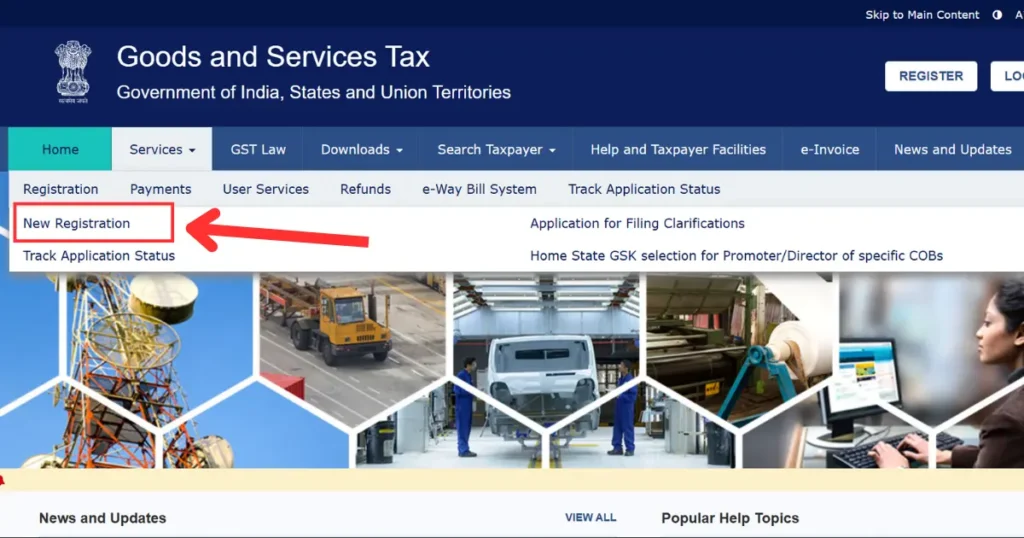

Step 2: Click on ‘Register Now’ under the Services tab

Step 3: Choose ‘New Registration’

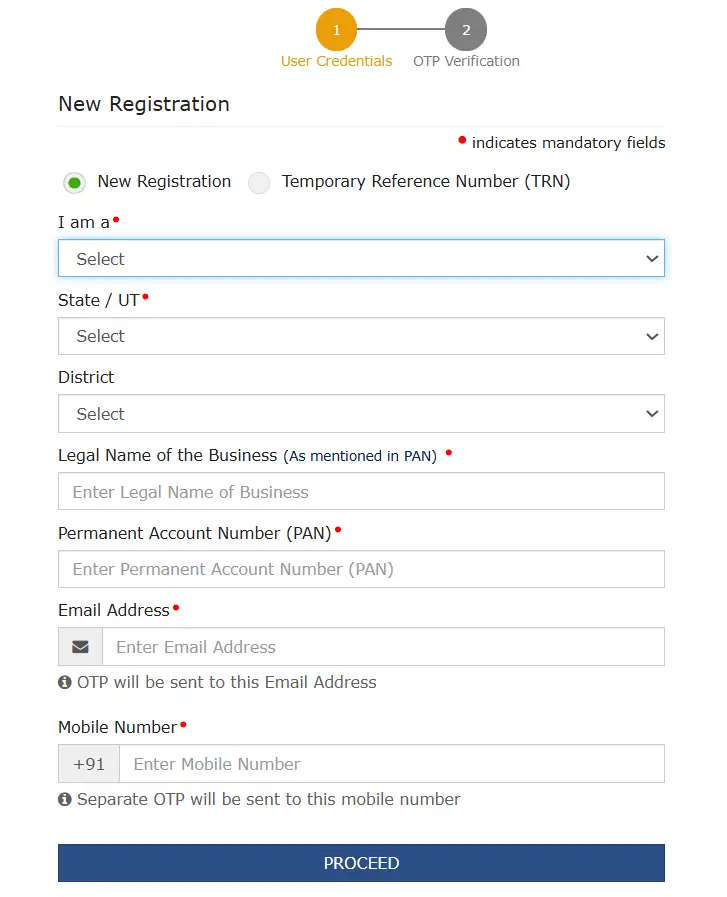

Step 4: Select your category and fill in the required information such as State, District, Legal Name of the Business, PAN, mobile number, and email.

Step 5: Fill in the captcha code and hit the “Proceed” button

Step 6: Verify the OTP you received on both mobile and email.

Step 7: Now complete the further application form by providing the required information and documents.

Step 8: Submit the form using OTP and DSC/e-signature.

Once your application is approved, your GST certificate online will be issued and available for download on the portal.

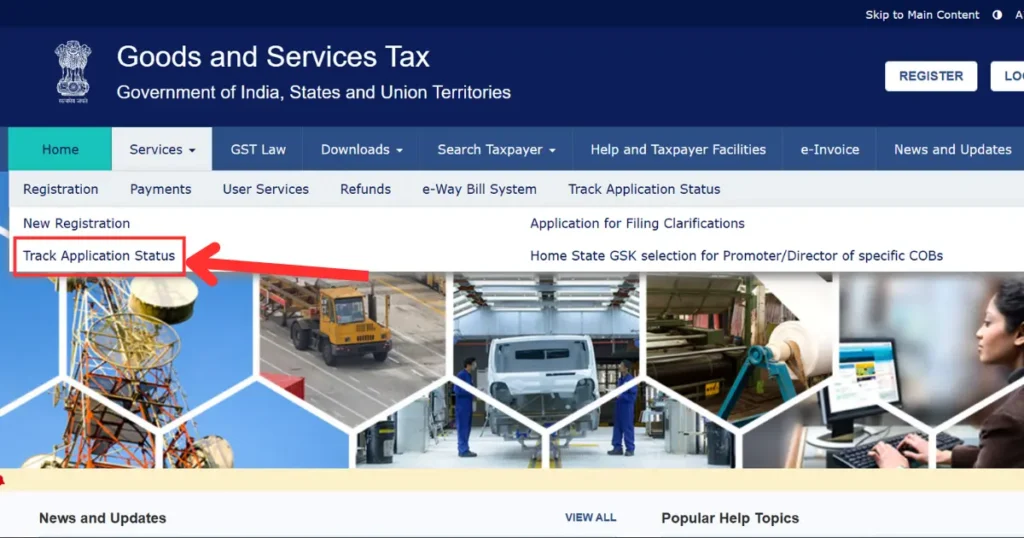

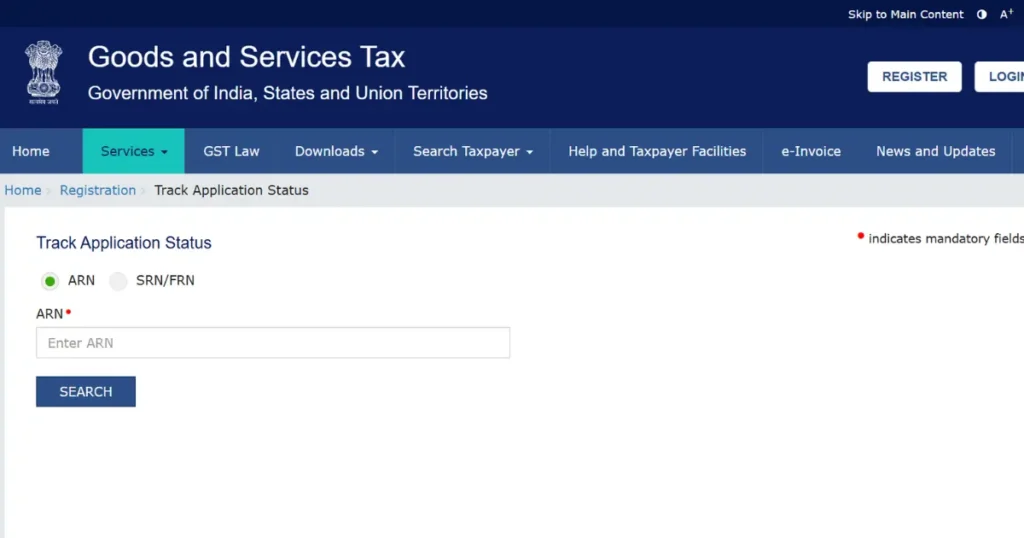

How to track GST Application Status?

You can track the status of your application for the GST registration certificate by following the steps below:

Step 1: Visit the GST Portal at www.gst.gov.in.

Step 2: Navigate to Services > Registration > Track Application Status.

Step 3: Enter your Application Reference Number (ARN).

Step 4: View the current status of your application.

How to Download GST Certificate from GST Portal?

Many users search for how to download a GST certificate directly from the GST portal. Here’s how you can do it:

- Go to www.gst.gov.in, the official portal for goods and service tax.

- Login using your Username and password.

- Navigate to Services, then User Services and then open View/Download Certificates.

- Click on the download icon to get your certificate in PDF format.

It is the official method of GST certificate download PDF online and ensures you get the original GST certificate from the Government’s system.

GST Certificate Download by PAN Number

You cannot directly download the certificate using only the PAN card. But you can search for the GSTIN, which is linked to your PAN:

- Go to www.gst.gov.in

- Select Search Taxpayer > Search by PAN.

- Enter your PAN number to find the associated GSTINs

- Use the GSTIN to log in and download the certificate

It is the method for GST certificate download by PAN number.

GST Certificate Download by GST Number

If you already have your GSTIN and login credentials, you can go directly to the GST portal and proceed to the download section. This process is also referred to as GST certificate download by GST number, the most common method business owners use.

Download GST Certificate Without Login – Is It Possible?

Many users often look for how to download GST certificate without login. However, per the GST rules, you cannot download the certificate directly without logging in.

Although you can search for a GSTIN and verify it publicly, the actual GST Certificate download without login is not allowed for privacy and data protection reasons. You must log in to your GST account to access and download the certificate.

Note that the Government has not provided any option to download the certificate without authentication. It will likely be unreliable or unsafe if someone claims to provide your certificate without logging in.

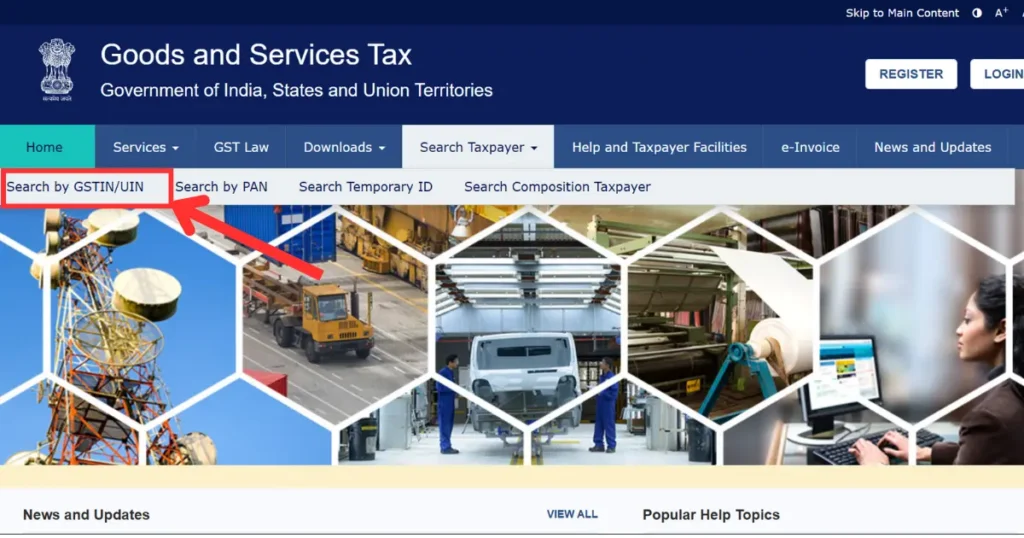

GST Certificate Verification Steps

To confirm if a GST number is valid, follow these steps for GST certificate verification:

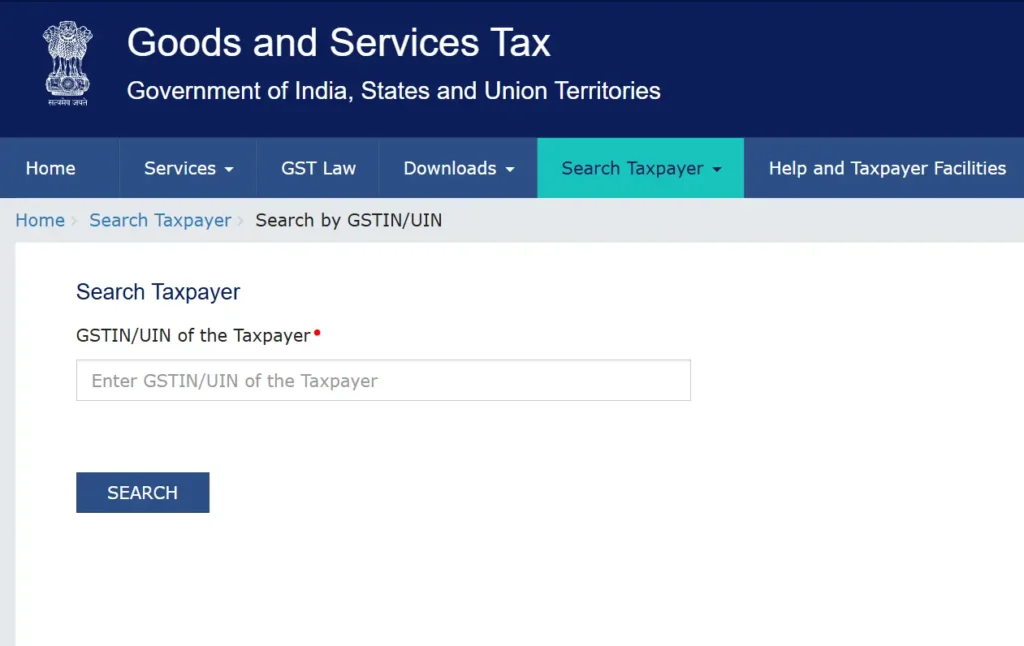

Step 1: Go to the GST Search Tool.

Step 2: Click on ‘Search Taxpayer’> ‘Search by GSTIN/UIN’. You can also choose other options for GST number Check.

Step 3: Enter the GSTIN mentioned on the certificate.

Step 4: The portal will display the registered business name, status, and place of business.

It ensures the certificate is genuine and matches government records.

The next question often raised is what is a GST Certificate Image, and Why Is It Useful? Nowadays, many businesses prefer to keep a visual copy of their GST registration certificate image for quick access or sharing over messaging platforms. You can create an image by the following steps:

- Taking a screenshot of the PDF

- Using an online PDF-to-image converter

Always ensure that your GST certificate image is clear and contains the QR code for authenticity.

Conclusion

A valid GST Registration Certificate is essential for every registered taxpayer operating a business in India. It not only acts as proof of compliance but also enhances the credibility of your business. Always ensure that your details are up to date and the certificate is downloaded from the official source.

Whether it’s GST certificate download, GST certificate verification, or how to download GST certificate, this guide has covered it all. For further help, consult a GST expert or visit the GST portal.

FAQs

Q 1: How to download GST certificate online?

Ans. To download GST certificate, log in to www.gst.gov.in, go to Services > User Services > View/Download Certificates and click the download icon.

Q 2: Can I download GST certificate without login?

Ans. No, downloading without login is not permitted by the GST system. Logging in is mandatory.

Q 3: How to get a GST registration certificate in PDF format?

Ans. After logging in, go to the certificate section and download the file as a PDF.

Q 4: How to do GST certificate verification?

Ans. Use the GST portal’s ‘Search by GSTIN’ feature to verify the certificate’s authenticity.

Q 5: Is there any way to get gst certificate download by pan number?

Ans. Yes. Search GSTIN using PAN, then use the login credentials linked with that GSTIN to download your certificate.

Q 6: What is the use of a GST certificate image?

Ans. A GST certificate image can be used for quick verification or sharing over platforms where PDF files aren’t supported.