e PAN Card Apply – The PAN Card is the most important document for financial and tax-related activities in India. Whether you’re an individual or a business entity, having a PAN Card is crucial for seamless financial transactions and compliance with tax laws. This step-by-step guide will provide you with all the essential details on how to apply for your PAN Card, understand its uses, and verify its authenticity.

With the convenience of applying online and the availability of the E PAN Card, obtaining and managing your PAN has become easier than ever. Additionally, Aadhar Card PAN Card link is now mandatory, making it essential to stay updated on the latest procedures.

By the end of this guide, you will have a clear understanding of the PAN Card Apply, Business PAN Card, e PAN Card, Aadhar Card PAN Card link, PAN card download, PAN card status, etc., ensuring that you can confidently handle your financial affairs.

What is a PAN Card?

A Permanent Account Number (PAN) Card is a unique 10-character alphanumeric identifier issued by the Income Tax Department of India. It serves as a vital tool for tracking and identifying every financial transaction an individual or entity makes. The PAN Card is not just a proof of identity but a mandatory document for a wide range of financial activities.

The structure of the PAN is such that it helps in detecting tax evasion by linking all financial transactions of an individual or entity.

Whether you are an individual taxpayer, a company, a trust, or a non-profit organization, having a NSDL PAN Card is crucial for conducting business smoothly and transparently in India.

What is an e PAN Card?

An e PAN Card is a digitally signed version of the PAN Card issued in an electronic format by the Income Tax Department. The e PAN Card holds the same validity as the physical PAN Card and is convenient for quick access and verification. The introduction of the e PAN is part of the government’s initiative to digitize and streamline financial processes.

One of the significant advantages of an ePAN is that it can be obtained much faster than the physical PAN Card. Typically, an e PAN Card can be issued within a few hours after the verification of the application. This makes it especially useful for situations where immediate proof of PAN is required.

Uses of PAN Card

The PAN Card serves multiple purposes, making it a crucial document for financial and legal processes. Here are some of the primary uses:

- Filing Income Tax Returns: The PAN Card is mandatory for filing income tax returns in India. It helps the Income Tax Department keep track of all financial transactions and ensure tax compliance.

- Opening a Bank Account: Whether it is a savings account, current account, or fixed deposit account, a PAN Card is necessary.

- Applying for Loans and Credit Cards: Financial institutions require a PAN Card to process applications for loans and credit cards.

- Buying and Selling Property: The PAN Card is required for transactions involving the purchase or sale of property.

- High-Value Transactions: For transactions above a certain limit, such as buying a car or jewelry, a PAN Card is needed.

- Investing in Securities: To invest in shares, mutual funds, and other securities, you must have a PAN Card.

Additionally, the PAN Card helps individuals and entities establish a credit history and is often required for KYC (Know Your Customer) processes in various financial and non-financial institutions.

Eligibility for PAN Card

The eligibility criteria for obtaining a PAN Card are straightforward. Essentially, anyone who is a taxpayer or intends to carry out financial transactions in India should have a PAN Card. This includes:

- Individuals: Both residents and non-residents of India can apply for a PAN Card.

- Minors: Parents or guardians can apply for a PAN Card on behalf of minors.

- Non-Resident Indians (NRIs): NRIs who have a source of income in India are also eligible for a PAN Card.

- Businesses: Companies, partnerships, trusts, and other entities must have a PAN Card to carry out financial transactions and comply with tax regulations.

The application process involves submitting proof of identity, proof of address, and proof of date of birth, along with the filled application form. For non-individual applicants, additional documentation related to the entity’s registration and identity (like Udyam Certificate) is required.

Required Documents for PAN Card Application

For Individual

- Aadhaar Card

- Passport size photo

- Email ID and Active Mobile number

For Company or Business

- ID Proof: Any ID of the Owner like PAN Card, Ration Card, Mark sheet (10th/12th/Graduation)

- Udyam Certificate or Udyam Registration number

- Bank Account

- Address Proof: Electricity Bill, Telephone bill, Rent Agreement

- Partnership Deed (in Case of Partnership)

- Bank Account Details

How to Apply for a PAN Card Online?

PAN Card Apply Online is a user-friendly and efficient process. The online application can be done through the NSDL or UTIITSL websites. Here is a step-by-step guide:

PAN Card Apply Online is a user-friendly and efficient process. The online application can be done through the NSDL or UTIITSL websites. Here is a step-by-step guide:

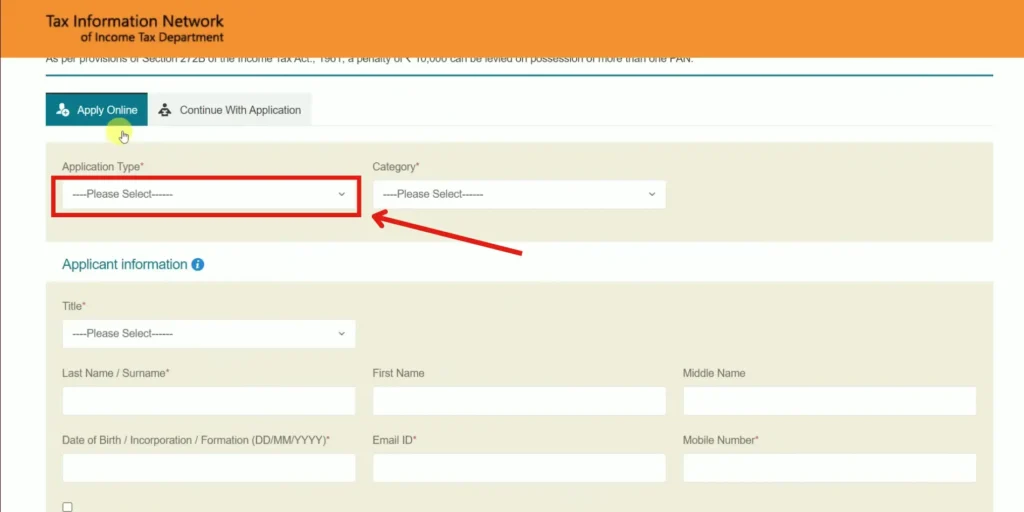

Step 1: Go to the official website of PAN Card Application NSDL or UTIITSL website.

Step 2: Choose Form 49A for Indian citizens and Form 49AA for foreign citizens in Application Type.

Step 3: Enter your personal information such as name, date of birth, address, and other required details accurately and “Submit”.

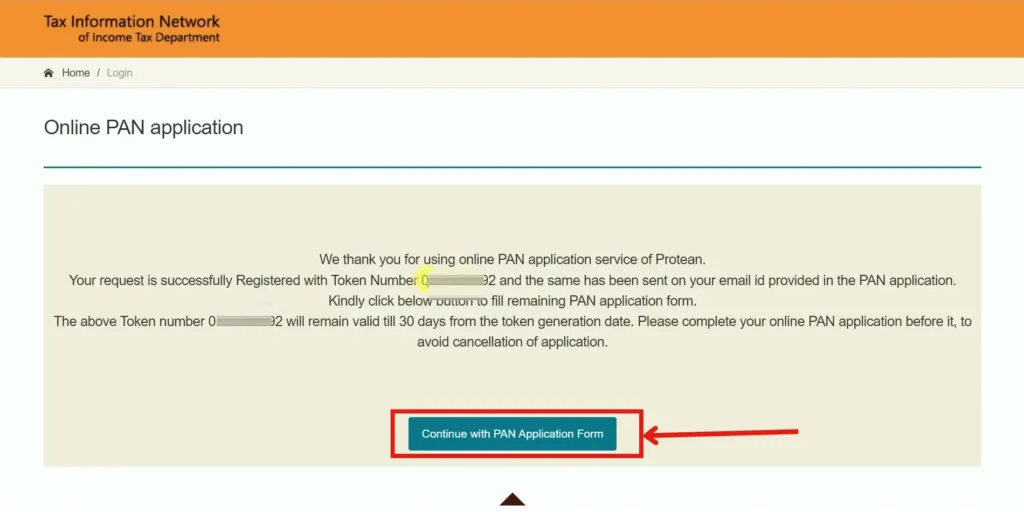

Step 4: You will get an Application Number Note down this number or take a screenshot for future use.

Step 5: Click on the ‘Continue with PAN Application Form’ button.

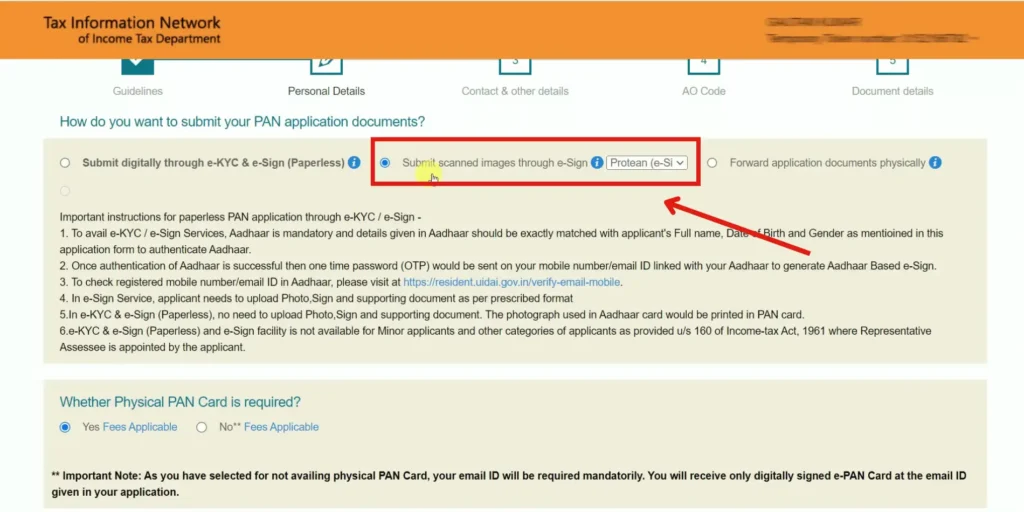

Step 6: On the next page choose ‘Submit Scanned Images through e-Sign’ And also select “Yes/No” in Whether Physical PAN Card is Required.

Step 7: Now fill in Aadhaar Number, Name as per Aadhaar, and other personal details like full name, gender, Parents details, etc.

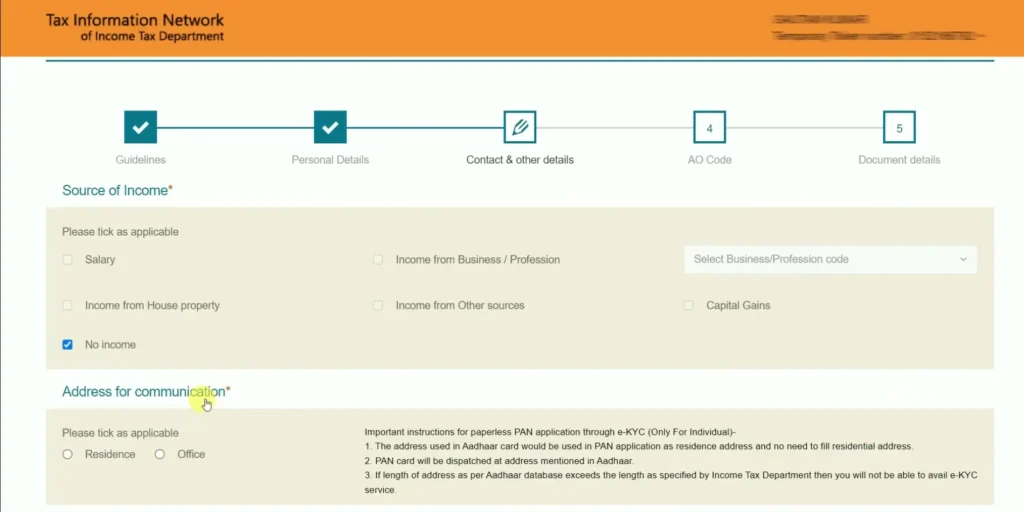

Step 8: On the next section of PAN Card Application enter Contact and other details like Source of Income, Address, Email etc.

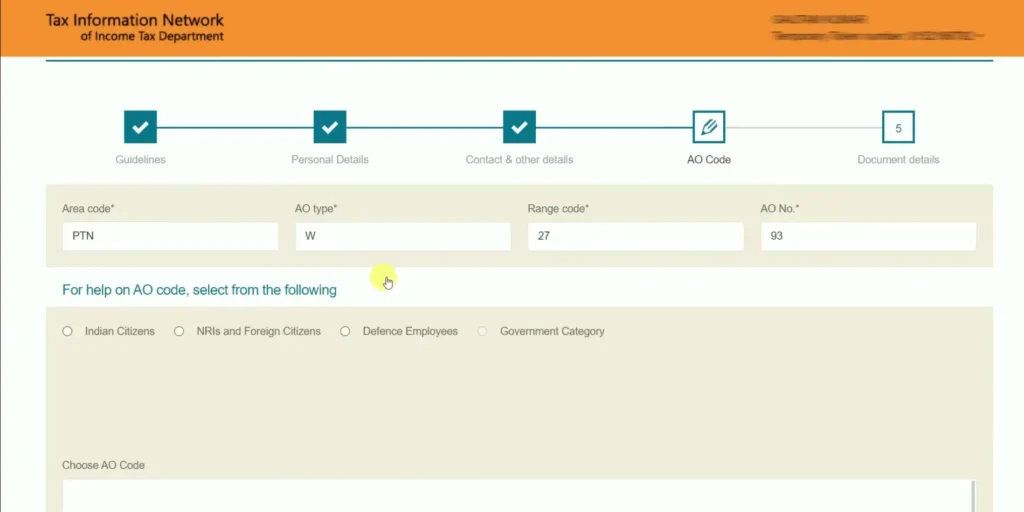

Step 9: Click the ‘Next’ button and enter AO Code Details. (You can fetch AO Code by choosing your area details)

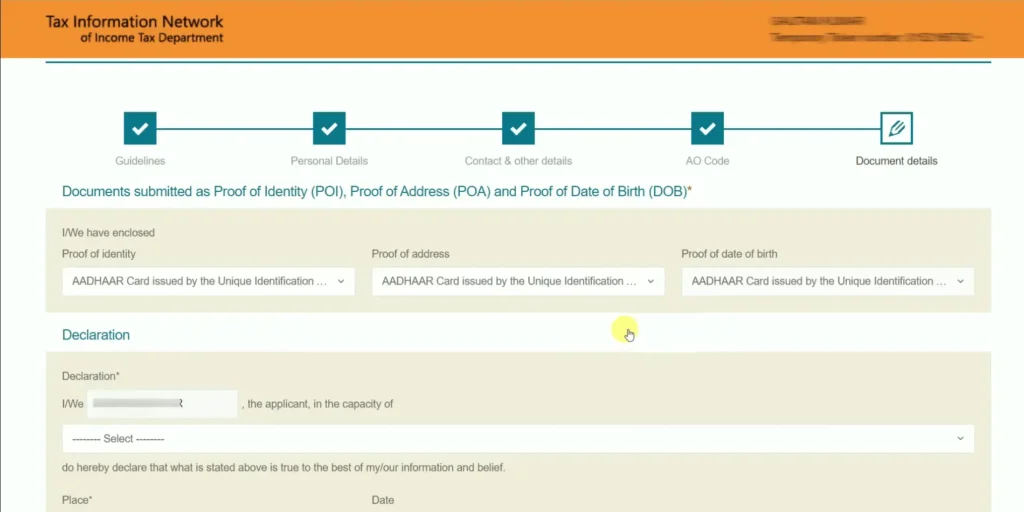

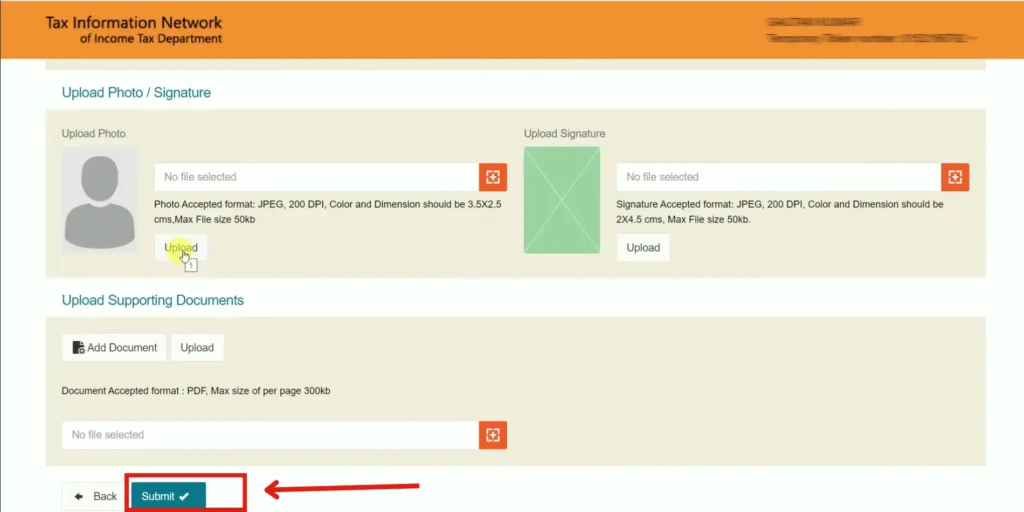

Step 10: Provide scanned copies of your proof of identity, proof of address, and proof of date of birth. Also upload a photo and signature according to the size described in the upload section.

Step 11: Click the ‘Submit’ button and review your application. You can correct any kind of error using the ‘Edit’ option.

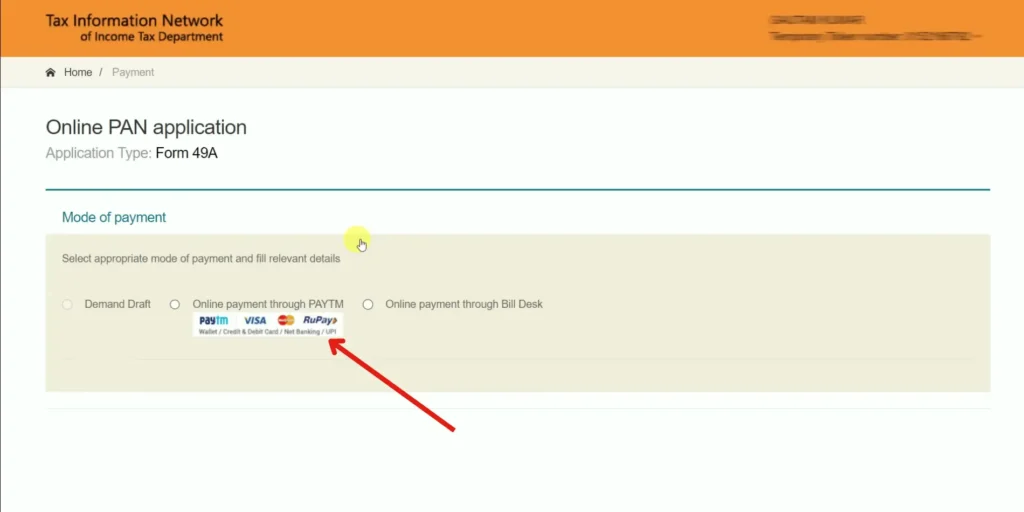

Step 12: Proceed for Payment page. Choose a Payment option and Pay the application fee.

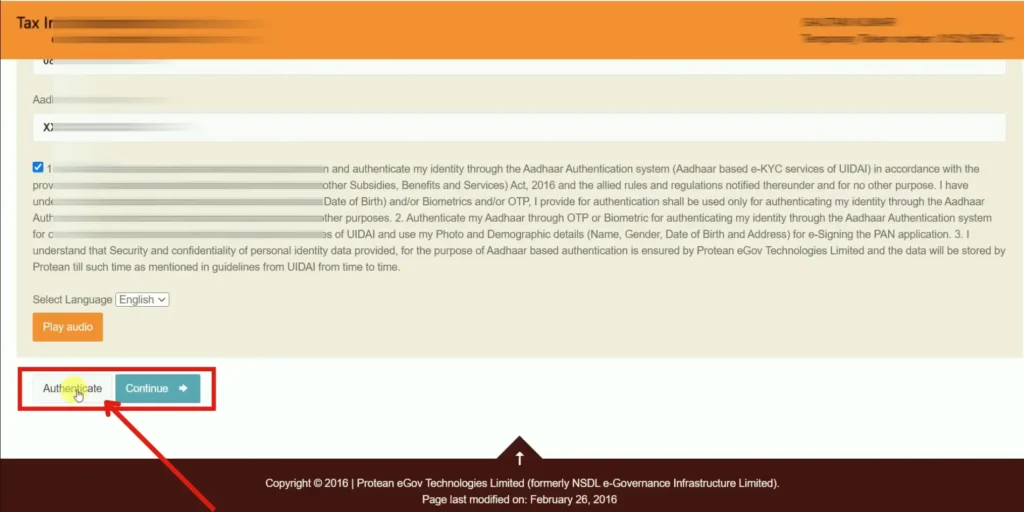

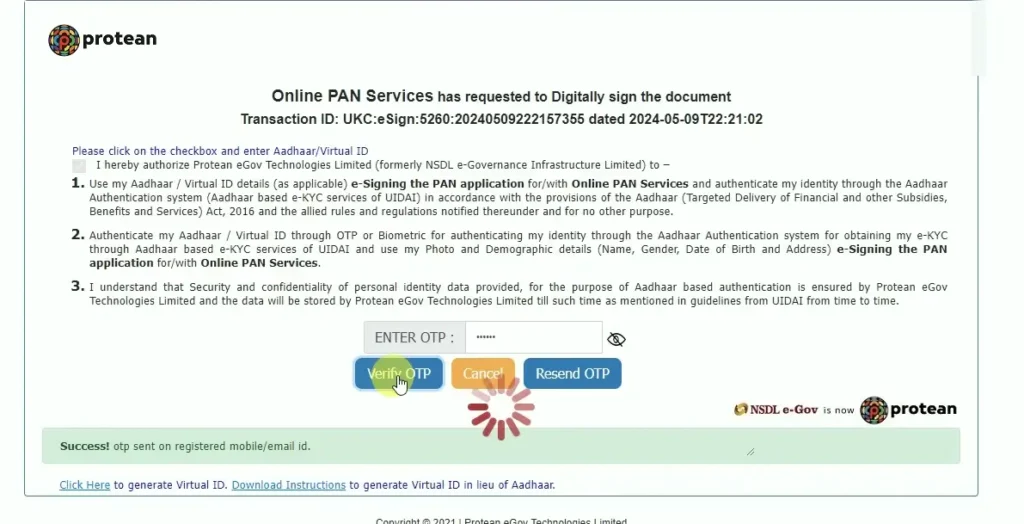

Step 13: After Payment Authenticate your application using Aadhaar. It will send you an OTP on your registered mobile number.

Step 14: After Aadhaar e-sign with OTP your application will be submitted.

Step 15: You can download your receipt for future use.

How to Check PAN Card Details by PAN Number?

Checking your PAN Card Details by PAN Number is simple and can be done online. Here’s how:

- Visit the Income Tax Department’s e-filing Website: Go to https://www.incometaxindiaefiling.gov.in.

- Select “Know Your PAN”: Under the “Quick Links” section, click on “Know Your PAN”.

- Enter Required Information: Provide your name, date of birth, and mobile number.

- Receive OTP: An OTP (One Time Password) will be sent to your registered mobile number.

- Enter OTP: Enter the OTP to authenticate your request.

- View Details: After successful verification, your PAN Card details will be displayed on the screen.

This process ensures that you can quickly retrieve and verify your PAN information whenever needed.

How to Verify PAN Card?

PAN Card Verification is crucial to ensure the authenticity of your PAN. This is particularly important for businesses and institutions that need to verify the PAN of their clients or employees. Here’s the process:

- Visit the Income Tax e-filing Portal: Go to https://www.incometaxindiaefiling.gov.in.

- Click on “Verify Your PAN Details”: This option is available under the “Quick Links” section.

- Enter PAN Details: Provide your PAN, full name, and date of birth.

- Submit Information: Click on “Submit” to initiate the verification.

- Verification Result: The portal will display whether the provided PAN details are correct and valid.

This verification process helps in confirming the legitimacy of the PAN Card and is widely used by financial institutions, employers, and government agencies.

FAQs

Q 1: Can I apply for a PAN Card if I am a minor?

Yes, minors can apply for a PAN Card. The application must be submitted by their parents or guardians. The PAN Card will carry the minor’s name and other details but the signature field will remain blank until the minor turns 18.

Q 2: Is it necessary to link PAN with Aadhaar?

Yes, the PAN Aadhaar Link Online is mandatory for filing income tax returns. This linkage helps in curbing tax evasion by ensuring that all financial transactions are tracked through a unified system.

Q 3: How long does it take to get a PAN Card?

It usually takes about 15 working days to receive your PAN Card after the application is submitted. However, in the case of an ePAN, the process can be completed within a few hours to a couple of days.

Q 4: What should I do if my PAN Card is lost or damaged?

You can apply for a reprint of your PAN Card online through the NSDL or UTIITSL website. The process involves filling out a request form, paying the requisite fee, and providing proof of identity.

Q 5: Can a business entity apply for a PAN Card?

Yes, business entities can apply for a Business PAN Card. This is essential for conducting business transactions and complying with tax regulations. The application process for businesses requires additional documentation related to the entity’s registration and identity.

Q 6: What is the fee for applying for a PAN Card?

The fee for applying for a PAN Card is INR 93 (excluding GST) for Indian communication addresses and INR 864 (excluding GST) for foreign communication addresses. The fee can be paid online.

Q 7: Can NRIs apply for a PAN Card?

Yes, Non-Resident Indians (NRIs) can apply for a PAN Card if they have a source of income in India. The process for NRIs is similar to that for resident Indians, with slight differences in the documentation required.

Q 8: How can I update or correct my PAN Card details?

If there are any discrepancies or if you need to update your details on the PAN Card, you can submit a correction request online through the NSDL or UTIITSL portal. This involves filling out a form, submitting the required documents, and paying a small fee.

Final Words

The PAN Card is an essential document for managing financial and tax-related transactions in India. From applying online to verifying details, this guide provides you with all the necessary steps to ensure you can obtain and use your PAN Card efficiently. Always ensure that your PAN is linked with your Aadhaar to stay compliant with regulations.

Applying for a PAN Card online is convenient, secure, and quick, ensuring you have all your tax and financial documentation in order. For the latest updates and procedures, always refer to the official government websites. By following this guide, you can seamlessly manage your financial activities.