Income Certificate – An Income Certificate or Aay Praman Patra is a document which plays a crucial role in various aspects of daily life. It is essential to get the benefits of various government initiatives for low-income groups, scholarships, etc. In this article, we will discuss all the significant aspects of an Income Certificate, such as its purpose, eligibility criteria, the application process, benefits of the Aay Praman Patra, etc.

What is an Income Certificate?

An Income Certificate or Aay Praman Patra is an official document that verifies an individual’s annual income level from different sources. It can be termed as official evidence of an individual’s yearly income. As compared to salaried employees, it is more important for non-salaried individuals to have an Annual Income Certificate.

Purpose of an Income Certificate

Aay Praman Patra serves various purposes, such as:-

- Verification of the annual income of an individual

- Financial transparency

- Assessing financial condition to check eligibility for specific subsidies and government schemes

Benefits of an Aay Praman Patra

The primary purpose of an Aay Praman Patra is to verify an individual’s Annual income from different sources. Especially for non-salaried individuals, it serves as evidence of their earning potential, as they don’t have any regular salary slips, income tax returns, etc.

An Aay Praman Patra holds significant importance in various situations, such as:

- It is required while applying for government subsidies/ benefits.

- You need an Aay Praman Patra while applying for scholarships for economically disadvantaged students.

- It is beneficial while applying for loans, especially educational loan applications where income is a criterion for eligibility.

- While applying for a passport, you need an Income Certificate.

- While applying for various government subsidies, such as the distribution of the ration under the Public Distribution System and other welfare initiatives focused on low-income groups.

- When applying for subsidized housing schemes, this certificate is beneficial.

- It is helpful while seeking admission to specific educational institutions.

- You will need it while applying for admissions in educational institutions or government employment under the EWS (Economically Weaker Section) quota.

Who is Eligible to Obtain an Income Certificate?

Every Indian citizen of any age, whether a salaried individual, self-employed, pensioner, or an individual with agricultural income, can apply for an Income Certificate. However, specific documentation requirements must be fulfilled according to the rules prescribed by authorities.

Validity of the Income Certificate

The Income Certificate has a fixed validity and must be renewed periodically. Generally, the validity period ranges from 6 months to 1 year, depending on the issuing authority and the specific purpose for which the Aay Praman Patra is required. However, you must check the validity of your Income Certificate as mentioned before submitting it for any official purpose. Once your certificate expires, you must apply for a fresh/new Income Certificate.

Application Fees for an Aay Praman Patra

The application fee for an income certificate varies across states and issuing authorities. However, generally, it ranges from Rs. 40-150.

Who Issues Income Certificates?

However, the issuing authority for an Aay Praman Patra varies across states. Generally, the Income Certificate is issued by:

- Village Administrative Officers/ Panchayat Pradhan can issue an Income Certificate for individuals living in villages.

- Tehsildars/Talukdars/ Circle Revenue Officers/ can issue Income Certificates for individuals residing in rural areas.

- Sub-Divisional Magistrates/ District Collectors are authorized to issue an Income Certificate for individuals residing in town/ city or urban areas.

- Employers can issue an Income Certificate for their salaried employees in certain situations.

- Other designated authorities, as specified by the State Government, also have the authority to issue Income Certificates.

Types of Income Certificates

There are two primary types of Income Certificates in India:-

- Aay Praman Patra for salaried employees: This certificate verifies the applicant’s annual income through salary slips, Income Tax Returns, and other relevant documents.

- Aay Praman Patra for non-salaried individuals: This Aay Praman Patra is for self-employed/ non-salaried individuals, agriculturists, pensioners, and individuals without regular salaried income. They must submit their bank statements, land ownership records, income tax returns, or other relevant proofs, showcasing income sources depending on their profession or occupation.

Process for Aay Praman Patra Application

Some states and authorities offer the facility of online applications for Aay Praman Patra, reducing the need for physical office visits. However, some states do not have this facility. In that case, you must follow the conventional offline method to get an Income Certificate. Some states follow a mixed pattern, including downloading the form for Income Certificate online and then applying offline.

Offline Application Process for an Income Certificate

If you want to make an offline Income Certificate application, you have to follow the steps given hereunder:

Step 1: Visit your nearest Gram Panchayat office, Tehsildar Office, or Revenue Office (If you are living in a rural area) and District Magistrate office, District Collector office, or Sub-Divisional Magistrate office (if you are living in an Urban area). Obtain the Aay Praman Patra form/ format from the issuing authority’s office.

Step 2: Paste your recent passport-size photograph and get it attested.

Step 3: Fill in all the required details, such as the name of the applicant, age, residential and permanent address, details of occupation, details of other family members and their occupation, details of income from various sources, details of tax returns, details of agricultural land, etc.

Step 4: Enter the details of the witness in the space given. Get it signed by a witness if required.

Step 5: Enter the date and name of the place, and put your signatures.

Step 6: Attach the required documents along with the application form. Here is a list of Income Certificate documents required:

- A valid government-issued photo ID, such as an Aadhaar card, PAN card, voter ID, driving license, passport, etc.

- Address proof, such as ration card, electricity bill, water bill, etc.

- Income proof, such as salary slips (Form 16 in case of salaried individuals), income tax returns, bank statements, property registration documents, rent receipts, etc. (In case of non-salaried individuals).

Step 7: Now pay the requisite fee to get it attested and verified by the designated authority. The designated authority will verify the submitted documents; if satisfied, he will certify the same. Your Aay Praman Patra is ready, and you can submit it to any institution wherever required.

Online Application Process for an Income Certificate

Generally, the process for an Income Certificate apply online in India involves similar steps. For your convenience, given below is the general application process for obtaining an Income Certificate online in various states:

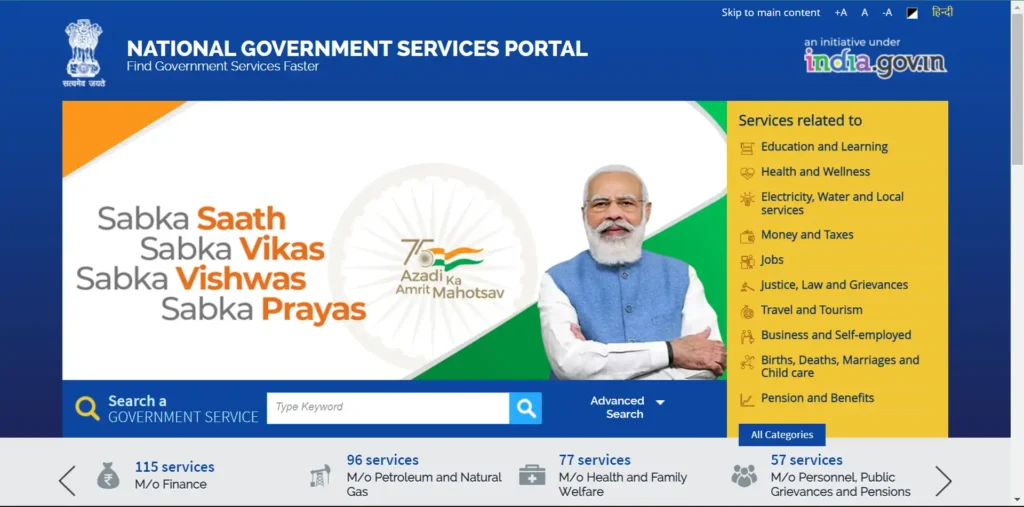

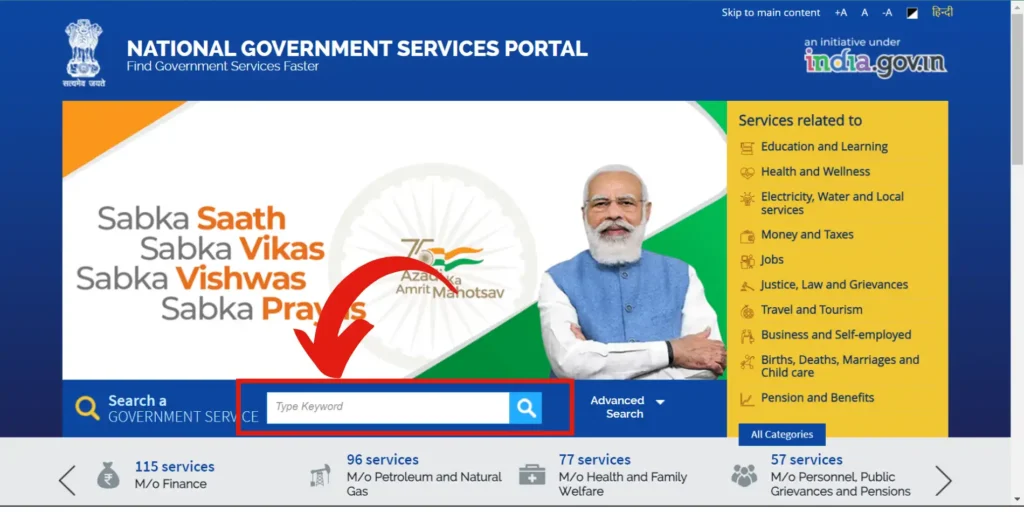

Step 1: Open your internet browser and visit the official website of the National Government Services Portal by clicking on this link: https://services.india.gov.in/?ln=en.

Step 2: Type “Income Certificate” in the search box and click the Search button.

Step 3: Now, from the results shown, click on the link containing the name of your state. For example, if you belong to Haryana, click “Income Certificate Haryana.”

Step 4: You will be directed to the official website of the concerned department of your state.

Step 5: Go to the “Sign In” section, enter your Login ID and Password, and click on the “Sign In.” If you don’t have a Login ID and Password, create one and Sign In.

Step 6: Look for the “Services” section and then “Income Certificate”. If you cannot find it directly, type and search “Income Certificate” in the search bar.

Step 7: Fill in all the required details such as the name of the applicant, age, residential and permanent address, details of occupation, details of other family members and their occupation, details of income from various sources, details of tax returns, details of agricultural land, etc.

Step 8: Upload all the required Income Certificate documents, such as:

- Recent passport-size photograph.

- A valid government-issued photo ID, such as an Aadhaar card, PAN card, voter ID, driving license, passport, etc.

- Address proof such as ration card, electricity bill, water bill, etc.

- Income proof such as salary slips (Form 16 In case of salaried individuals), income tax returns, bank statements, property registration documents, rent receipts, etc. (In case of non-salaried individuals).

Step 9: Pay the requisite fee through an online gateway such as PhonePay, Google Pay, Paytm, Debit Card, Credit Card, etc, and then submit the application.

Step 10: After the verification process is complete on the part of designated authorities, you can download the Income Certificate form PDF and take a printout.

How to Download Income Certificate?

The general step-by-step process for an Income Certificate download is as follows:

Step 1: Open your internet browser and visit the official website of the National Government Services Portal by clicking on this link: https://services.india.gov.in/?ln=en.

Step 2: Type “Income Certificate” in the search box and click the Search button.

Step 3: Now, from the results shown, click on the link containing the name of your state. For example, if you belong to Haryana, click on the link “Income Certificate Haryana”.

Step 4: You will be directed to the official website of the concerned department of your state.

Step 5: Go to the “Download Certificates” section, enter your Application Number or Receipt Number, and click the “Download” button.

Step 6: Check your Income Certificate in your device’s “Download” folder. If you want, you can also take a printout of your certificate.

Note: Though this is a generalized process, the actual process to download the Aay Praman Patra may vary slightly across various states.

False information in an application for an Aay Praman Patra

If you provide false information to obtain an Aay Praman Patra, it is illegal, and you will have to face legal consequences. So, you must be careful when entering the required information in the Income Certificate application form.

FAQs

Q. Whether a person who is not employed can obtain an Income Certificate?

Ans. Yes, everyone can obtain an Aay Praman Patra regardless of employment. Moreover, an income certificate relates to the applicant’s income and the family’s annual income from different sources.

Q. For how long an Income Certificate is valid?

Ans. An Income Certificate is generally valid for six months to a year and must be renewed afterwards.

Q. What happens if one gives false information in the application for obtaining an Income Certificate?

Ans. Giving false information in the application for an Income Certificate is illegal, and one will have to face the legal consequences.

Q. What is my income proof?

Ans. Your income proof can be your parent’s Aay Praman Patra if you are not earning, their income tax returns, etc. If you are an earning individual, you can use your salary certificate as an income proof.

Q. What should be the minimum income to obtain an Income Certificate?

Ans. Income equal to or less than 4.5 lakh, including all sources, is the minimum to get a certificate.

Q. What to do if my Income Certificate is lost?

Ans. You can go to the nearest government post office where your certificate is registered and apply for a duplicate Aay Praman Patra in case your original one is lost, destroyed, or stolen.

Q. How to track the status of my Aay Praman Patra application?

Ans. For your Income Certificate status check, you can login to the online e-district portal and navigate the application status option. You have to enter your application reference number, and the current status of your application will be shown on your screen.

Conclusion

In this article, we have discussed all the essential aspects of an Income Certificate. We hope you find this article informative and valuable. For more such articles, please keep visiting our website regularly and join our WhatsApp group and Telegram Channel for all the latest updates.